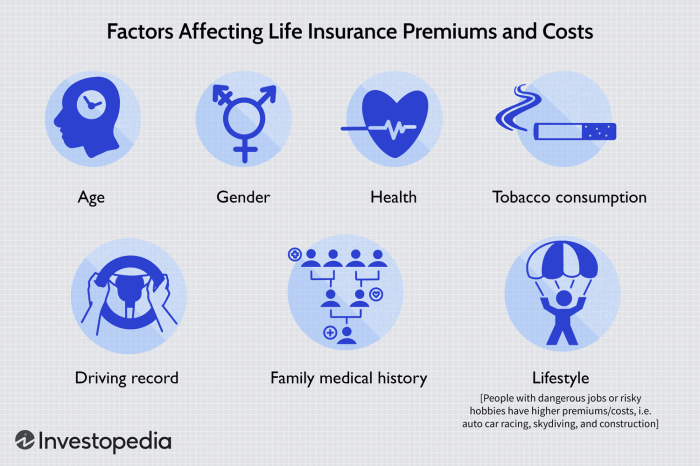

Exploring the key elements that impact your life insurance quote, this article dives into the various factors that play a crucial role in determining the cost of your coverage. From age and health history to lifestyle choices and coverage types, understanding these components is essential in securing the right policy for your needs.

Factors Impacting Life Insurance Quotes

Age, health history, and lifestyle choices are three key factors that significantly influence the cost of life insurance premiums.

Age

Age plays a crucial role in determining life insurance quotes. Generally, the younger you are when you purchase a policy, the lower your premiums are likely to be. This is because younger individuals are considered lower risk to insurers, as they are statistically less likely to pass away during the policy term.

Health History

Your health history is another major determinant of life insurance premiums. Insurers assess your medical records, pre-existing conditions, and family history to gauge your overall health status. Individuals with a clean bill of health typically receive lower premiums, while those with chronic illnesses or risky health conditions may face higher costs.

Lifestyle Choices

Lifestyle choices such as smoking, alcohol consumption, and exercise habits can also impact life insurance quotes. Smokers, for example, are often charged higher premiums due to the increased health risks associated with tobacco use. On the other hand, individuals who maintain a healthy lifestyle through regular exercise and balanced diet may qualify for lower rates.

Coverage Amount and Type

When it comes to life insurance, the coverage amount and type play a significant role in determining the premium you’ll pay. The coverage amount refers to the sum of money that will be paid out to your beneficiaries upon your death.

The higher the coverage amount, the higher the premium is likely to be. This is because the insurance company is taking on a greater risk by agreeing to pay out a larger sum of money.

Types of Life Insurance Policies

Different types of life insurance policies can impact the quotes you receive. Here are a few examples:

- Term Life Insurance: This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. Term life insurance tends to be more affordable compared to other types of policies because it does not build cash value.

- Whole Life Insurance: Whole life insurance provides coverage for your entire life and includes a savings component that grows over time. Premiums for whole life insurance are typically higher than term life insurance.

- Universal Life Insurance: This policy offers more flexibility in terms of premium payments and death benefits. It combines a death benefit with a savings account that earns interest over time.

Term Length Influence on Premiums

The term length of a life insurance policy can also impact the premiums you pay. Typically, the longer the term of the policy, the higher the premiums will be. This is because the insurance company is taking on a greater risk by providing coverage for a longer period of time.

Shorter terms, such as 10 years, may have lower premiums compared to longer terms, such as 30 years.

Occupation and Hobbies

Occupation and hobbies play a significant role in determining life insurance rates. Insurers take into consideration the level of risk associated with your occupation and hobbies when calculating your life insurance quote.

Impact of Occupation on Life Insurance Rates

Your occupation can greatly affect your life insurance rates. Jobs that are considered high-risk, such as working in construction or as a firefighter, may result in higher premiums. This is because these occupations are associated with a higher likelihood of injury or death, leading to greater risk for the insurance company.

Effect of Engaging in High-Risk Hobbies

Engaging in high-risk hobbies like skydiving, racing, or scuba diving can also impact your life insurance quotes. These activities are considered risky and could increase the chances of an early death or injury. As a result, insurers may charge higher premiums to cover the additional risk.

Importance of Accurate Disclosure

It is crucial to disclose accurate information about your occupation and hobbies to insurers when applying for life insurance. Failure to do so could result in a denied claim in the future if it is discovered that you provided false information.

By being transparent about your occupation and hobbies, you can ensure that you receive the appropriate coverage and premium rate.

Medical Examinations and Underwriting

Medical exams play a crucial role in the life insurance application process as they provide insurers with valuable information about the applicant’s health status. These exams help underwriters assess the risk associated with insuring an individual, which in turn influences the life insurance quotes offered.

Underwriting Criteria

- Body Mass Index (BMI): Insurers consider BMI as it is an indicator of overall health. Higher BMIs may result in higher premiums.

- Cholesterol Levels: Elevated cholesterol levels can indicate a higher risk of cardiovascular disease, leading to increased insurance rates.

- Blood Pressure: High blood pressure is linked to various health issues, and individuals with hypertension may face higher life insurance premiums.

Pre-existing Conditions

- Pre-existing conditions such as diabetes, heart disease, or cancer can significantly impact life insurance premiums. Insurers may charge higher rates or impose exclusions related to these conditions.

- Individuals with chronic illnesses may be considered high-risk by insurers, leading to more expensive life insurance coverage.

Summary

In conclusion, the factors influencing your life insurance quote are multifaceted and interconnected. By grasping the nuances of these elements, you can make informed decisions that align with your financial goals and provide the necessary protection for your loved ones.

Questions and Answers

How does age affect life insurance quotes?

Age is a significant factor in determining life insurance premiums, with younger individuals typically receiving lower quotes due to lower perceived risk.

What role does health history play in life insurance premiums?

Health history impacts premiums as insurers assess the risk of insuring an individual based on past medical conditions and treatments.

How do lifestyle choices like smoking influence life insurance quotes?

Smoking can lead to higher premiums as it is associated with various health risks, affecting the overall cost of life insurance.

What are the different types of life insurance policies and how do they impact quotes?

Term life, whole life, and universal life policies have varying impacts on quotes based on factors like coverage duration and benefits.

Why is it important to disclose accurate information about occupation and hobbies?

Accurate disclosure ensures that insurers can assess the level of risk accurately, leading to fair and appropriate life insurance quotes.

How do medical examinations influence life insurance applications?

Medical exams help insurers evaluate an individual’s health status, which is crucial in determining the risk and cost associated with a policy.

What role do pre-existing conditions play in life insurance premiums?

Pre-existing conditions can impact premiums by increasing the perceived risk for insurers, potentially leading to higher quotes.