Term vs Whole Life Insurance Quotes: Which Is Better for You? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

This topic delves into the comparison between term and whole life insurance, shedding light on the nuances that can help individuals make informed decisions about their insurance needs.

Term Life Insurance

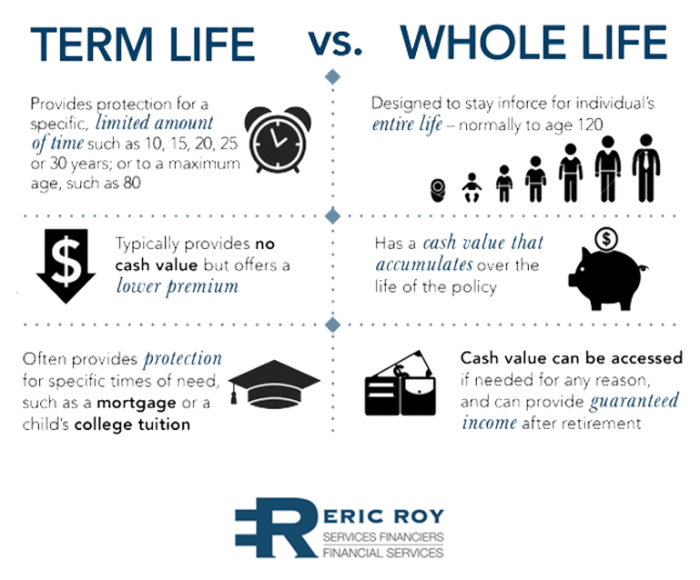

Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiaries receive a death benefit. However, if the policyholder outlives the term, the coverage expires.

Suitable Situations for Term Life Insurance

Term life insurance is a suitable choice for individuals who need coverage for a specific period, such as:

- Young parents who want to ensure financial protection for their children until they are grown and independent.

- Individuals with significant debts or loans that need to be covered in case of unexpected death.

- People with a limited budget looking for affordable life insurance coverage.

Benefits of Term Life Insurance

Compared to whole life insurance, term life insurance offers the following benefits:

- Lower premiums: Term life insurance typically has more affordable premiums compared to whole life insurance, making it a cost-effective option.

- Flexibility: Term life insurance allows policyholders to choose the coverage term based on their specific needs and financial goals.

- Simplicity: Term life insurance is straightforward and easy to understand, with no cash value accumulation or investment component.

Cost Implications of Term Life Insurance

Term life insurance is generally more affordable than whole life insurance due to its temporary nature and lack of cash value accumulation. The cost of term life insurance depends on factors such as the policyholder’s age, health, coverage amount, and term length.

Younger and healthier individuals typically pay lower premiums for term life insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which is for a specific term, whole life insurance offers lifelong protection as long as premiums are paid.

Situations Suitable for Whole Life Insurance

- Individuals looking to provide financial support for their loved ones after their passing.

- Those interested in building cash value over time.

- People who want a guaranteed death benefit for their beneficiaries.

Benefits of Whole Life Insurance

- Provides coverage for life, ensuring beneficiaries receive a payout upon the insured’s passing.

- Accrues cash value over time that can be borrowed against or withdrawn.

- Offers a guaranteed death benefit, providing peace of mind to policyholders.

Investment Aspect of Whole Life Insurance

Whole life insurance combines insurance coverage with a savings component, allowing policyholders to build cash value over time. This cash value grows tax-deferred and can be accessed through policy loans or withdrawals. Additionally, some whole life policies pay dividends, providing an additional source of income for policyholders.

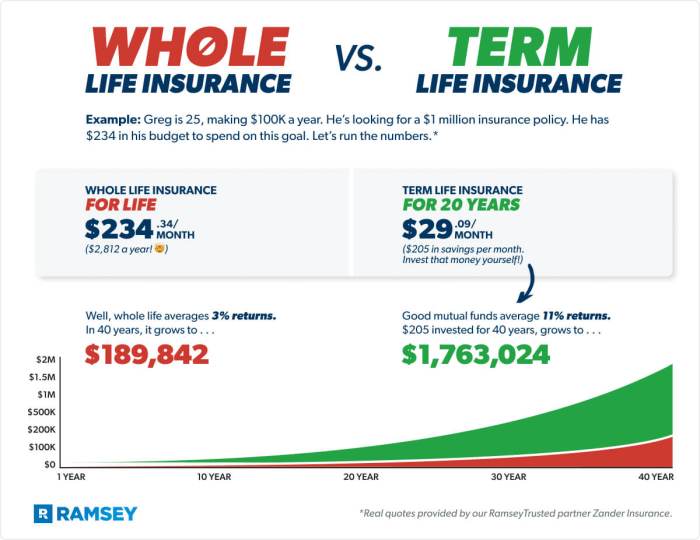

Quotes Comparison

When it comes to comparing insurance quotes for term life insurance and whole life insurance, it’s essential to understand how these quotes are calculated and what factors influence them.Insurance quotes for term life insurance are typically calculated based on factors such as the individual’s age, health status, the desired coverage amount, and the length of the term.

Younger individuals in good health usually receive lower quotes compared to older individuals or those with pre-existing health conditions. The premium for term life insurance remains fixed for the duration of the term chosen.On the other hand, insurance quotes for whole life insurance take into account similar factors such as age and health status.

However, these quotes are higher than those for term life insurance due to the cash value component and lifelong coverage provided by whole life policies. The premiums for whole life insurance are typically higher but remain level throughout the policyholder’s lifetime.The process of obtaining quotes for term life insurance is usually more straightforward and cost-effective compared to whole life insurance.

Since term life insurance provides coverage for a specific period, quotes are lower as there is no cash value accumulation or investment component involved. In contrast, obtaining quotes for whole life insurance involves a more extensive underwriting process due to the cash value feature and lifelong coverage, resulting in higher premiums.Factors that influence insurance quotes for both types of insurance include age, health status, lifestyle habits, occupation, coverage amount, and length of the policy term.

Additionally, the insurance company’s underwriting guidelines, financial stability, and the policyholder’s location can impact the quotes provided.Overall, understanding how insurance quotes are calculated for term life insurance and whole life insurance can help individuals make informed decisions when choosing the right policy based on their needs and financial goals.

Suitability and Considerations

When deciding between term and whole life insurance, there are several factors to consider to ensure you choose the most suitable option based on your individual needs and financial goals. Understanding the differences in coverage and how they align with your specific circumstances is crucial in making an informed decision.

Comparison of Coverage

- Term Life Insurance:

- Provides coverage for a specific period, such as 10, 20, or 30 years.

- Offers a death benefit to beneficiaries if the insured passes away during the term.

- Generally more affordable than whole life insurance.

- Whole Life Insurance:

- Offers coverage for the entire lifetime of the insured.

- Includes a cash value component that grows over time and can be borrowed against.

- Guarantees a death benefit payout to beneficiaries regardless of when the insured passes away.

Individual Needs and Financial Goals

- Consider your financial obligations, such as mortgage payments, college tuition, and other debts.

- Assess your long-term financial goals, such as retirement planning and legacy building.

- Evaluate your current health status and potential future medical needs.

Tips for Choosing the Most Suitable Insurance Type

- Review your budget and determine how much you can afford to pay for premiums.

- Understand the length of coverage you need based on your financial obligations and goals.

- Consult with a financial advisor or insurance professional to get personalized recommendations.

- Compare quotes from multiple insurance providers to find the best coverage at a competitive rate.

Wrap-Up

In conclusion, the choice between term and whole life insurance ultimately depends on individual circumstances, financial goals, and risk tolerance. By weighing the benefits and drawbacks of each, individuals can secure the most suitable coverage for themselves and their loved ones.

Detailed FAQs

What factors should I consider when choosing between term and whole life insurance?

Factors to consider include budget, coverage needs, financial goals, and risk tolerance. Term insurance is typically more affordable, while whole life insurance offers lifelong coverage and an investment component.

How are insurance quotes calculated for term life insurance?

Insurance quotes for term life insurance are based on factors such as age, health, coverage amount, and term length. Younger, healthier individuals usually receive lower quotes.

What are some situations where whole life insurance is a suitable choice?

Whole life insurance is beneficial for individuals seeking lifelong coverage, estate planning, or a policy with a cash value component. It can also be used as a tool for wealth transfer.