Navigating the world of life insurance can be overwhelming, but with the convenience of getting instant quotes online, the process becomes much simpler. This guide will walk you through the steps of obtaining quick life insurance quotes with ease and efficiency.

Exploring the various types of life insurance available and understanding the factors that influence quotes will empower you to make informed decisions about your coverage.

Researching Life Insurance Quotes Online

When looking for life insurance coverage, it is essential to research multiple quotes to find the best policy that suits your needs and budget. By comparing different options, you can ensure that you are getting the most value for your money and the right coverage for your future.

The Importance of Researching Multiple Life Insurance Quotes

Researching multiple life insurance quotes allows you to compare different policies, coverage amounts, and premiums offered by various insurance providers. This helps you make an informed decision based on your specific needs and budget.

How Online Comparison Tools Can Help

Online comparison tools make it easy to gather and compare instant life insurance quotes from multiple providers in one place. These tools allow you to input your information once and receive quotes from different companies, saving you time and effort in the process.

Factors to Consider When Comparing Instant Life Insurance Quotes Online

- Policy Coverage: Look at the coverage amount and type of policy offered to ensure it meets your needs.

- Premiums: Compare the premiums for each policy to find a balance between affordability and coverage.

- Term Length: Consider the term length of the policy and how it aligns with your long-term financial goals.

- Customer Reviews: Check customer reviews and ratings for the insurance providers to gauge their reputation and customer service quality.

Using Online Insurance Websites

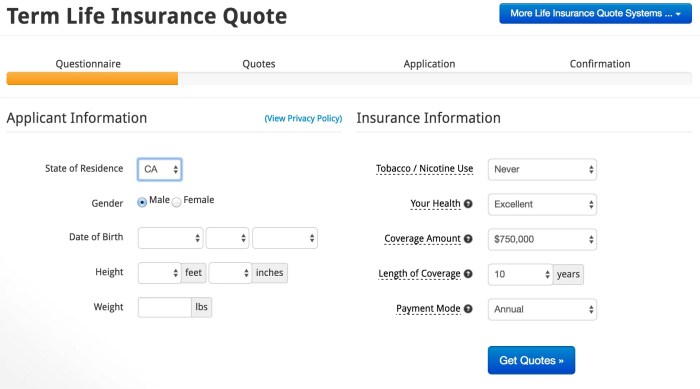

When it comes to getting instant life insurance quotes online, using insurance websites is a convenient and efficient way to compare different options. These websites allow you to input your information and receive accurate quotes quickly.

Navigating Different Insurance Websites Effectively

- Start by researching reputable insurance websites that offer instant quotes.

- Compare the user interface and ease of navigation on different websites to find one that suits your preferences.

- Look for websites that provide detailed information about the types of coverage available and the process for obtaining a quote.

Inputting Accurate Information for Accurate Quotes

- Provide truthful and up-to-date information about your age, health, lifestyle, and coverage needs.

- Double-check all the data you input to ensure accuracy and avoid discrepancies in the quotes.

- Be prepared to answer questions about your medical history and habits to receive the most accurate quotes.

Factors Influencing Life Insurance Quotes

When obtaining life insurance quotes online, several factors come into play that can affect the cost of your policy. Understanding these factors can help you make informed decisions and potentially lower your premiums.Age is a significant factor that influences life insurance quotes.

Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk compared to older individuals.Health is another crucial factor in determining life insurance quotes. Insurance companies will assess your overall health, including any pre-existing conditions, lifestyle choices, and family medical history.

Maintaining good health through regular exercise and a balanced diet can help improve your chances of securing lower premiums.Occupation also plays a role in life insurance quotes. Some professions are considered riskier than others, leading to higher premiums. For example, individuals working in hazardous jobs may face higher insurance costs compared to those in low-risk occupations.Lifestyle choices, such as smoking, excessive drinking, or engaging in dangerous activities, can impact your life insurance quotes.

Insurers may charge higher premiums to individuals with unhealthy habits due to the increased risk of premature death.By understanding these factors and making positive changes where possible, such as adopting a healthier lifestyle or choosing a less risky occupation, you can improve your chances of receiving lower life insurance quotes online.

Last Recap

In conclusion, obtaining an instant life insurance quote online is a convenient way to secure your financial future and protect your loved ones. By researching, using online tools, and understanding the different types of policies, you can make the best choice for your needs.

Stay informed and insured for peace of mind.

FAQ Guide

Is it necessary to research multiple life insurance quotes online?

Yes, researching multiple quotes allows you to compare prices and coverage options to find the best policy for your needs and budget.

What factors can impact the cost of life insurance quotes online?

Factors such as age, health status, occupation, and lifestyle choices can influence the quotes you receive. Maintaining a healthy lifestyle and providing accurate information can help lower your premiums.

What is the difference between term life insurance and whole life insurance for online quotes?

Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage with a cash value component. Understanding the differences can help you choose the right policy for your needs.