Exploring the realm of life insurance quotes can lead to significant savings. This guide delves into the intricacies of comparing quotes, offering valuable insights and tips for maximizing your benefits.

Understanding the components, factors, and types of life insurance policies is crucial in making informed decisions.

Understanding Life Insurance Quotes

Life insurance quotes are estimates provided by insurance companies that detail the cost of a life insurance policy based on various factors. These quotes can help individuals compare different policies and choose the one that best suits their needs and budget.

Components of a Life Insurance Quote

- The premium: This is the amount you pay regularly to keep the policy active.

- The coverage amount: This is the sum of money that will be paid out to your beneficiaries upon your death.

- The policy term: This is the length of time the policy will be in effect.

- The type of policy: Different types of policies, such as term life or whole life, will impact the quote.

Factors Influencing Life Insurance Quotes

- Age: Younger individuals generally receive lower quotes as they are considered lower risk.

- Health: Your current health status and any pre-existing conditions can affect the cost of the policy.

- Smoking habits: Smokers typically pay higher premiums due to the increased health risks associated with smoking.

- Occupation: Some occupations are considered riskier than others, leading to higher quotes.

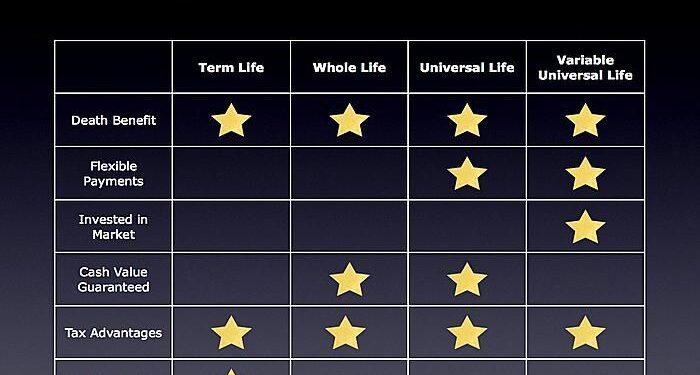

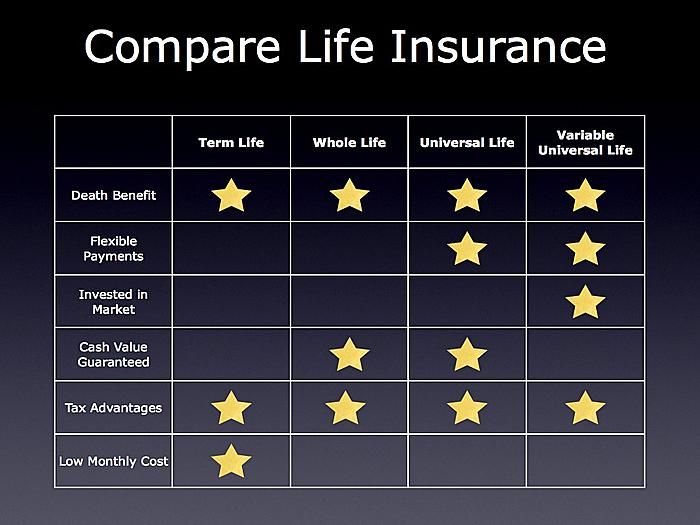

Types of Life Insurance Policies

- Term life insurance: Provides coverage for a specific term, usually 10, 20, or 30 years.

- Whole life insurance: Offers lifetime coverage along with a cash value component that can grow over time.

- Universal life insurance: Combines a death benefit with a savings component that earns interest.

- Variable life insurance: Allows policyholders to invest their premiums in various investment options.

How to Compare Life Insurance Quotes

When looking to compare life insurance quotes, it’s essential to consider various factors to ensure you’re getting the best coverage at the most competitive rates. Here is a step-by-step guide on how to effectively compare life insurance quotes:

1. Compare Coverage and Premiums

Before making a decision, carefully review the coverage offered by different insurance companies. Make sure the policies provide the necessary protection for your needs. Additionally, compare the premiums for each policy to understand the cost of coverage.

2. Evaluate Reputation and Financial Stability

It’s crucial to assess the reputation and financial stability of the insurance companies you are considering. Look into customer reviews, ratings, and complaints to get a sense of the company’s track record. Furthermore, check their financial strength ratings from reputable agencies to ensure they can fulfill their financial obligations.

Ways to Save Money on Life Insurance

When it comes to life insurance, everyone wants to find the best coverage at the most affordable rates. Here are some tips to help you save money on your life insurance premiums.

Comparing Term Life Insurance vs. Whole Life Insurance

Term life insurance is typically more affordable than whole life insurance. Term policies provide coverage for a specific period, such as 10, 20, or 30 years, while whole life insurance covers you for your entire life. If you’re looking to save money on premiums, term life insurance may be the better option for you.

Impact of Lifestyle Choices on Life Insurance Rates

Your lifestyle choices can have a significant impact on your life insurance rates. Factors such as smoking, excessive drinking, and risky hobbies can increase your premiums. By making healthier choices and reducing risky behaviors, you can potentially lower your life insurance rates.

Other Ways to Save on Life Insurance

- Bundle your policies: Consider bundling your life insurance with other insurance policies, such as auto or home insurance, to receive discounts.

- Stay healthy: Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can lead to lower life insurance rates.

- Shop around: Don’t settle for the first life insurance quote you receive. Compare quotes from multiple insurers to find the best rates.

- Choose the right coverage amount: Avoid over-insuring yourself by selecting a coverage amount that meets your needs without unnecessary extras.

Utilizing Online Tools for Comparing Quotes

When it comes to comparing life insurance quotes, utilizing online tools can be a convenient and efficient way to find the best coverage for your needs. Online platforms offer a variety of options to compare quotes from different insurance providers, helping you save time and money in the process.

Popular Online Platforms for Comparing Life Insurance Quotes

- Policygenius: A popular platform that allows you to compare quotes from multiple insurance companies and offers personalized recommendations based on your needs.

- Insure.com: Another well-known website where you can compare quotes and read reviews of different insurance providers to make an informed decision.

- NetQuote: This platform allows you to compare quotes for various types of insurance, including life insurance, and helps you find the most competitive rates.

Using Online Calculators to Estimate Coverage Needs

Online calculators are valuable tools that can help you estimate the amount of coverage you may need based on factors such as your age, income, debts, and future financial goals. By inputting this information into the calculator, you can get a better understanding of how much coverage would be sufficient for your loved ones in the event of your passing.

Advantages and Limitations of Using Online Tools for Comparing Quotes

- Advantages:

- Convenience: Online tools allow you to compare quotes from multiple providers without the need to visit each company individually.

- Time-saving: Instead of spending hours on the phone or meeting with insurance agents, you can quickly compare quotes online in a matter of minutes.

- Transparency: Online platforms provide transparency by showing you a range of quotes and coverage options, allowing you to make an informed decision.

- Limitations:

- Lack of Personalization: Online tools may not take into account your specific needs and circumstances, leading to a more generalized recommendation.

- Inaccurate Quotes: The quotes provided online may not always be accurate, as they are based on the information you input and may not reflect the final premium you receive.

- No Human Interaction: Some people prefer the personal touch of speaking with an insurance agent to address their questions and concerns, which online tools may not provide.

Concluding Remarks

In conclusion, navigating the world of life insurance quotes can be daunting, but with the right knowledge and tools, you can secure a policy that meets your needs and saves you money in the long run.

FAQ Overview

How can I lower my life insurance premiums?

To lower your premiums, consider improving your health, opting for term life insurance, and comparing quotes from different providers.

What factors should I consider when comparing coverage and premiums?

When comparing coverage and premiums, look at the policy benefits, exclusions, riders, and any additional costs associated with the coverage.

Is it better to choose term life insurance or whole life insurance for cost savings?

Term life insurance generally offers lower premiums and can be more cost-effective for those looking for temporary coverage.

How do lifestyle choices affect life insurance rates?

Lifestyle choices such as smoking, alcohol consumption, and participation in risky activities can lead to higher life insurance rates due to increased health risks.